A Periodic Inventory System Measures Cost of Goods Sold by

Cost of goods sold COGS Beginning inventory Purchases Closing inventory. The calculation of the cost of goods sold under the periodic inventory system is.

Chapter 5 1 Chapter 5 2 Chapter 5 Accounting For Merchandising Operations Accounting Principles Ninth Edition Ppt Download

Equal to the beginning inventory plus purchases made during the period less sales revenue for the period.

. Periodic inventory is an accounting inventory method where inventory and cost of goods sold are calculated at the end of an accounting period rather than on a daily basis. Compute the cost of goods sold under a periodic system and create journal entries. The inventory account and the cost of goods sold account are updated at the end of a set periodthis could be once a month once a quarter or once a year.

COGS BI P EI Where BI Beginning Inventory. Global Positioning System GPS Tracking Device. Beginning Balance of Inventory Cost of Inventory Purchases - Cost of Ending Inventory Cost of Goods Sold Since.

A periodic inventory system provides better control over inventories than a perpetual system. Making entries to the inventory account for each purchase and sale. In a periodic inventory system the cost of goods sold is determined by.

Journal entries made at the time of each sales transaction. In a periodic inventory system the cost of goods sold is determined only at the end of the accounting period. The cost of goods sold is 1500.

What we have now learned is that using the periodic inventory system the cost of goods sold COGS is computed as follows. Estimating the amount of. Multiple Choice Recorded as sales transactions occur.

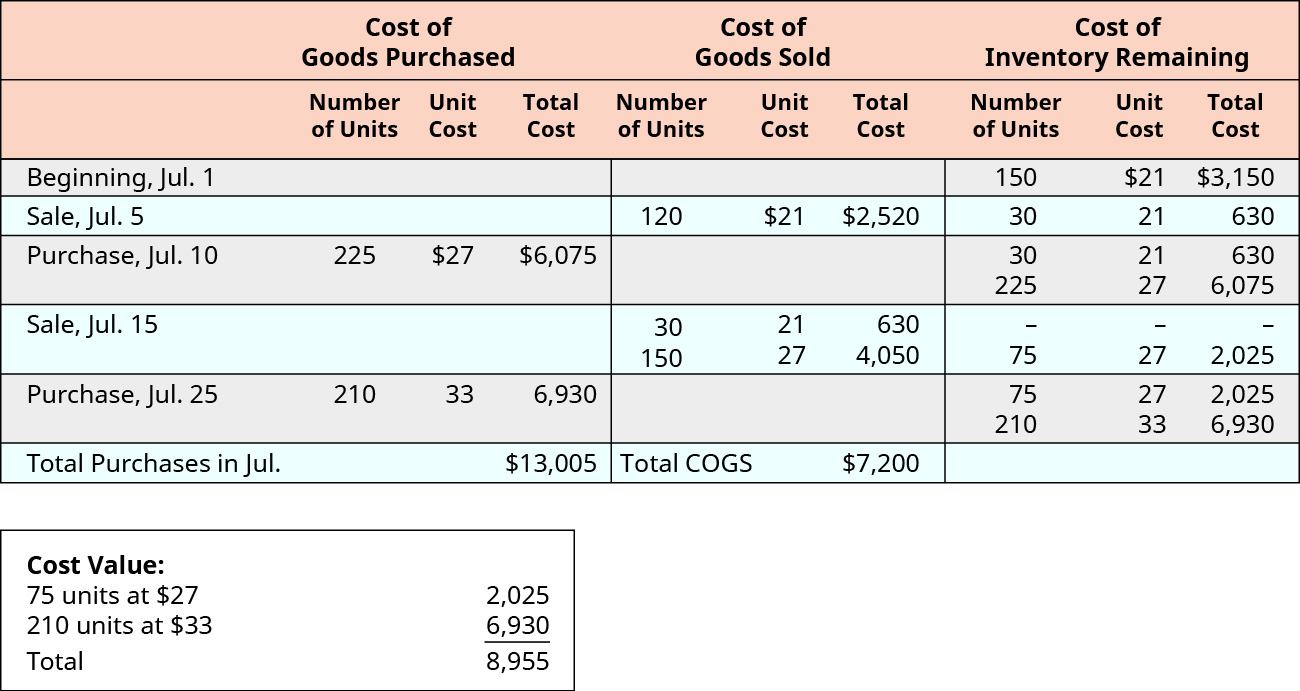

After a given period cost of sales and inventory balances are determined -opposite of perpetual 8. Under the periodic inventory system the cost of goods sold is calculated in a lump sum at the end of the reporting period by adding total purchases to the beginning inventory and subtracting ending inventory while the perpetual system allows continual updates to the cost of goods sold account with each sale. The Cost of Goods Sold COGS In the perpetual inventory method the COGS is also calculated perpetually.

Spy Who Loves You Corporation. In contrast the perpetual inventory system is a method that continuously monitors a businesss inventory balance by automatically updating inventory records after each sale or purchase. Debit Cost of Goods.

Beginning inventory Purchases Cost of goods available for sale Cost of goods available for sale Ending inventory Cost of goods sold. Beginning inventory Purchases net of returns and allowances and purchase discounts freight in Ending inventory Cost of goods sold. Cost of Goods Sold.

As the product gets sold it increases the cost of sales aka Cost of Goods Sold COGS. A periodic inventory system measures the level of inventory and cost of goods sold through occasional physical counts. The periodic system uses an occasional physical count to measure the level of inventory and the cost of goods sold.

It doesnt however account for broken damaged or lost goods. A periodic inventory system measures cost of goods sold by Multiple choice question. Determined by a computation which is performed at year-end after the taking of a complete physical inventory.

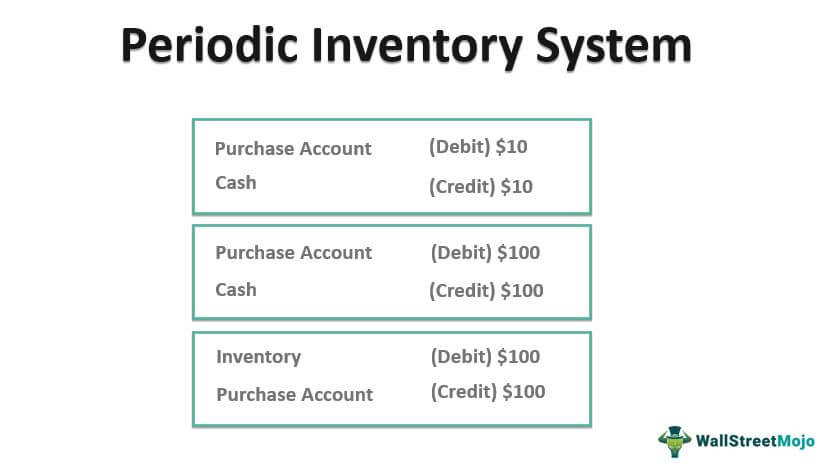

The total amount in the purchases account is added to the beginning inventory to calculate the cost of goods available for sale. In a periodic system all transactions conducted are listed in a purchase account for the company which monitors inventory based on deduction of the cost of goods sold COGS. Estimating the amount of inventory sold.

Cost of goods sold under the periodic inventory system is calculated as follows. A periodic inventory system measures cost of goods sold by Multiple choice question. Debiting cost of goods sold for all purchases of inventory.

The general formula for calculating the cost of goods sold as per the periodic inventory system is as follows. These audits include regular physical inventory counts on a scheduled and periodic basis. Making entries to the inventory account for each purchase and sale.

This product is an economical real-time GPS tracking device designed for individuals who wish to monitor others whereaboutsIt is being marketed to parents of middle school and high school students as a safety measure. In a periodic inventory system the cost of goods sold is. What is the entry required to record the expense of the inventory sold.

Margot Inc which uses the perpetual inventory system purchases 500 units of inventory to be held for resale. Which is where a company undertakes regular audits of stock to update inventory information. The perpetual system keeps track of inventory balances continuously with updates made automatically whenever a product is received or sold.

Cost Data for Calculations. A periodic inventory system measures cost of goods sold by. Counting inventory at the end of the period.

Periodic Inventory System The periodic inventory system refers to conducting a physical inventory of goodsproducts on a scheduled basis. Counting inventory at the end of the period. Periodic inventory systems can make sense for small to midsized businesses with a low number of products sold while large and growing business opt for the perpetual.

Debiting cost of goods sold for all purchases of inventory. The periodic inventory system uses an occasional physical count to measure the level of inventory and the cost of goods sold COGS. It encompasses the money invested in producing goods along with labor and material costs.

Counting inventory at the end of the period. Multiplying net sales for the period by a cost ratio.

Periodic Inventory System Definition Journal Entries

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

No comments for "A Periodic Inventory System Measures Cost of Goods Sold by"

Post a Comment